Bitcoin reached a new all-time high above $124,000 Wednesday night, as investor confidence swelled amid expectations of U.S. rate cuts and continued institutional support.

Bitcoin climbed to a new all-time high of $124,128 on Wednesday, August 13th, according to CoinGecko, as optimism over U.S. monetary policy and a wave of institutional buying fueled the latest leg of the rally. The move marks a fresh milestone for the world’s largest digital asset, which has already gained more than 30% since the start of the year.

The latest surge was propelled by growing market conviction that the Federal Reserve will cut interest rates at its next meeting. Futures markets are pricing in a strong probability of a September reduction, with dovish signals from policymakers encouraging investors to shift capital toward riskier assets. The U.S. dollar weakened in tandem, further boosting Bitcoin’s appeal as a hedge and alternative store of value.

Institutional Buying Pushes Bitcoin Past Google

Institutional demand has played a central role in the climb. Spot Bitcoin exchange-traded funds have seen sustained inflows in recent weeks, while corporate treasuries and investment funds continue to increase their holdings. Bitcoin’s market capitalization has climbed above $2.4 trillion, briefly pushing it ahead of Google to become the fifth-largest asset in the world, according to data from Companiesmarketcap.com. The milestone underscores Bitcoin’s growing presence alongside the world’s most valuable publicly traded companies and commodities.

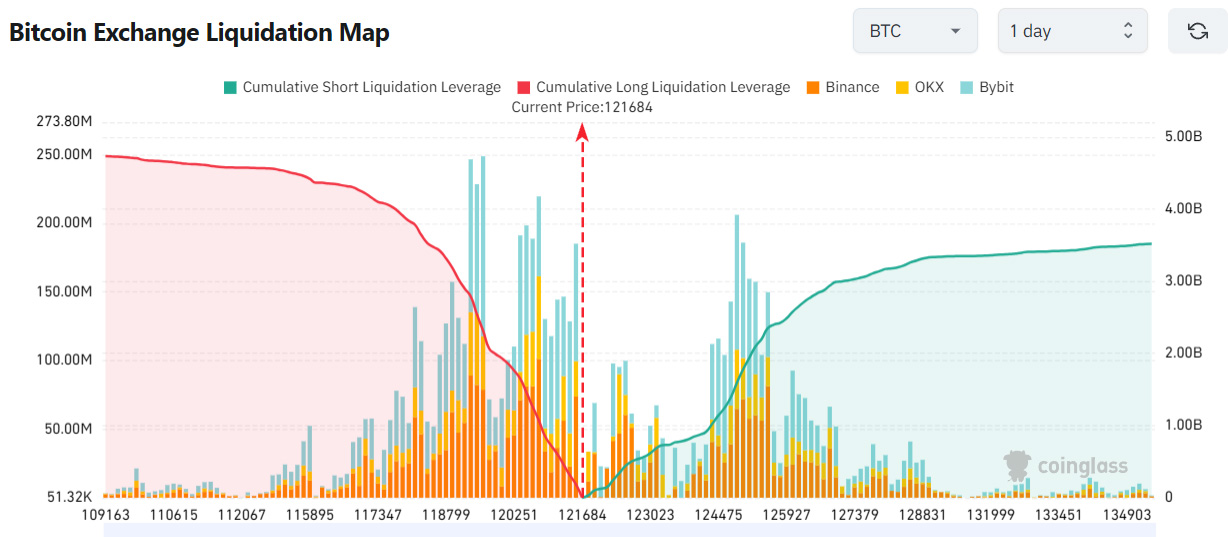

The price action was also influenced by strong derivatives activity. Data from CoinGlass shows a spike in leveraged positions and short liquidations, which intensified buying pressure and helped drive prices to the record high. Although the rally paused after touching the peak, the market remains buoyant, with analysts pointing to $135,000 as the next potential target if momentum continues.

Source: CoinGlass

Source: CoinGlass

Policy Shifts Open New Avenues

Policy developments have added another tailwind. Earlier this month, President Donald Trump officially signed a landmark executive order that would will allow tens of millions of Americans to allocate retirement savings from 401(k) accounts into cryptocurrencies such as Bitcoin. Supporters see the move as a gateway for significant long-term capital inflows, further cementing Bitcoin’s place in mainstream finance.

While some long-term holders have taken advantage of the rally to lock in profits, on-chain data suggests the majority of supply remains in strong hands. Volatility, however, remains a fixture of the market.

By press time, Bitcoin had eased from its record, trading around $121,680, as traders digested the sharp run-up and some investors took profits. Despite the pullback, sentiment remains broadly positive, with market participants watching closely for signs of renewed momentum.