Bitcoin surged past $68,000 today, marking a significant milestone as the leading digital asset continues its upward trajectory.

As of press time, Bitcoin was trading at $68,235, up by 4.2% in the last 24 hours and an impressive 9.8% over the past week. This marks the first time Bitcoin has reached these levels since late July 2024, adding fresh optimism to the market, which had been relatively stagnant for the last few months.

The price surge comes at a time when crypto markets have become more liquid and sophisticated, according to the latest report by Coinbase Institutional and blockchain analytics firm Glassnode. The report, titled Q4 2024 Guide to Crypto Markets, highlights several positive trends that signal increased maturity in the digital asset space.

One of the primary drivers of Bitcoin’s recent surge is the increase in on-chain activity and trading volumes, which suggests that the market is becoming more liquid. The report points to a 76% increase in Bitcoin’s monthly trading volumes year-to-date, averaging $2 trillion, a substantial rise compared to 2023.

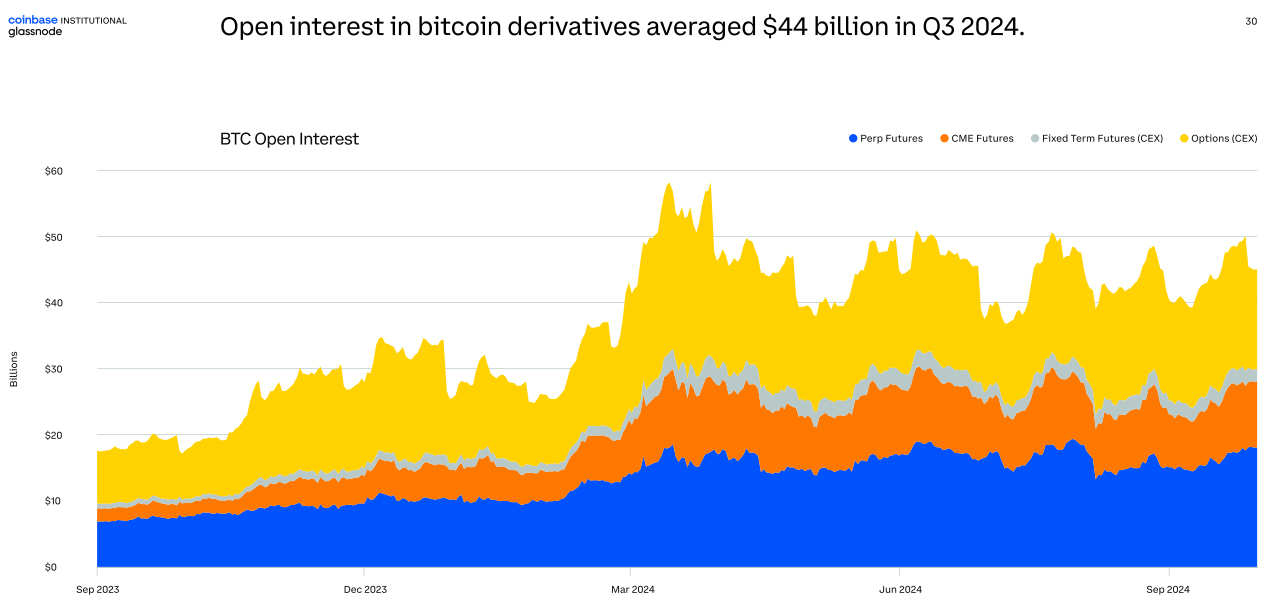

This liquidity boost has been accompanied by growing interest in Bitcoin derivatives. The report noted that open interest in Bitcoin derivatives, a key indicator of future price movements, averaged $44 billion in the third quarter of 2024.

Source: Q4 2024 Guide to Crypto Markets

Analysts also emphasized that recent market corrections, particularly the liquidation of long positions, have left the market in a “cleaner” state, which could further support upward price movements.

“BTC positioning looks cleaner after significant long liquidations,” the report stated, adding that these liquidations helped reset the market, potentially laying the groundwork for future price increases.

Bitcoin’s current price trajectory brings it within striking distance of its all-time high of $73,800, which it reached earlier in 2024. That rally was driven by the approval of several spot Bitcoin exchange-traded funds (ETFs) in the U.S., as well as Bitcoin’s fourth halving event, which took place in April. The halving reduced the block reward for miners, making Bitcoin more scarce and historically contributing to price increases.