Bitcoin’s recent market movements underscore its volatile nature, with the leading cryptocurrency bouncing back from a low of $57,250 to regain ground above $58,000 on Monday, September 2. This recovery comes as cryptocurrency exchanges report a significant drop in Bitcoin reserves, marking a notable shift in market dynamics.

Data from CoinGecko shows that Bitcoin’s price briefly dipped to $57,257 before rallying to $58,465 at the time of this writing, reflecting a flat performance for the day and a 8.6% decline over the past week. This downturn is set against a backdrop of continuing outflows from digital asset investment products and a shrinking supply of Bitcoin on exchanges.

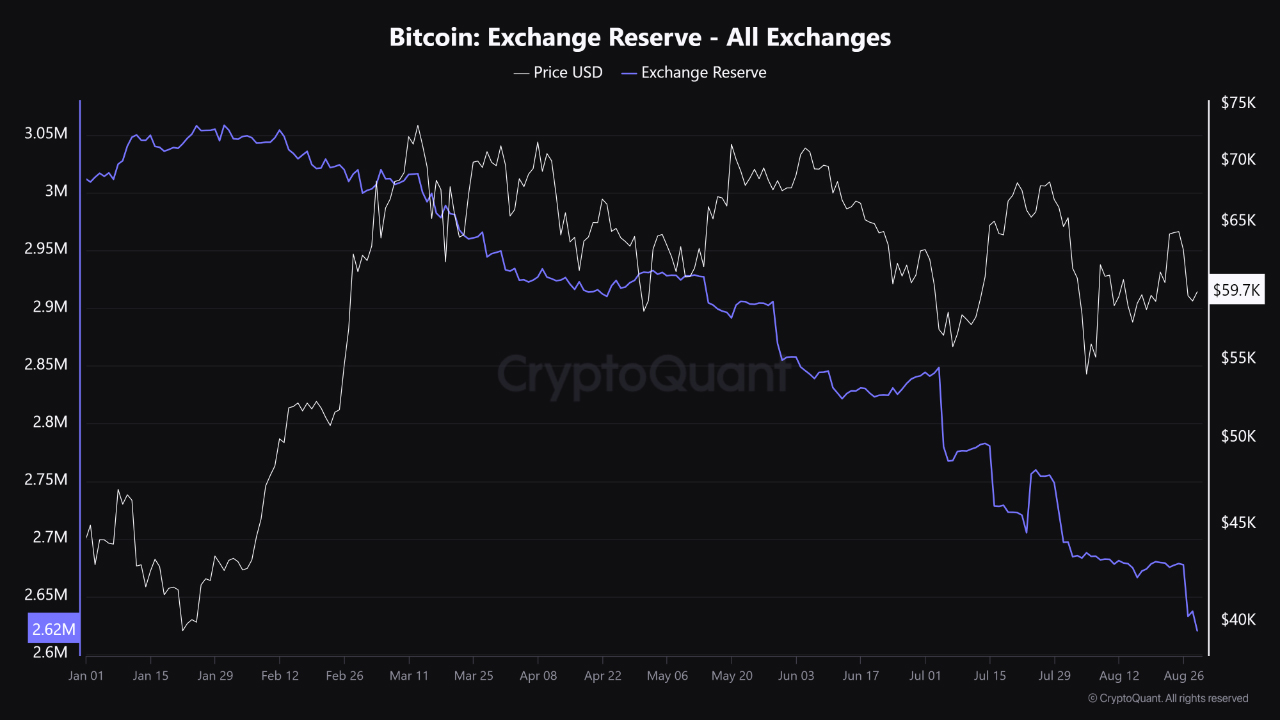

The global Bitcoin exchange reserves have plummeted to just 2.39 million BTC, down by 25% from their peak in 2020. This reduction in available Bitcoin on exchanges typically signals a move toward long-term holding, as investors transfer their assets to more secure, private wallets. Such trends can often lead to reduced selling pressure, potentially stabilizing or boosting Bitcoin’s price over the long term.

Source: CryptoQuant

Source: CryptoQuant

However, the market’s immediate outlook remains uncertain. The past 24 hours saw $169.2 million in liquidations across the crypto market, according to CoinGlass, with long positions bearing the brunt of the losses, accounting for $125.59 million of the total.

Adding to the pressure, a recent CoinShares report highlighted a wave of negative sentiment that swept through digital asset investment products last week. The report revealed outflows totaling $305 million, with Bitcoin alone accounting for $319 million in withdrawals. This stark contrast is attributed to stronger-than-expected economic data from the United States, which has dimmed hopes for a significant interest rate cut from the Federal Reserve.

James Butterfill, Head of Research at CoinShares, noted that the optimism surrounding potential rate cuts has waned, contributing to the pullback in investment. Interestingly, while Bitcoin investment products saw significant outflows, short Bitcoin products experienced their second consecutive week of inflows, totaling $4.4 million—the largest since March this year. This suggests that some investors are positioning themselves to profit from further declines in Bitcoin’s price.

Growing Adoption of Self-Custody Strategies

As Bitcoin navigates this turbulent period, its reduced availability on exchanges could play a crucial role in its future trajectory. With fewer coins available for trading, any significant demand increase could drive prices higher.

A CryptoQuant analyst has linked the reduction in exchange reserves to the growing adoption of self-custody strategies among Bitcoin holders. With more investors opting to move their BTC off exchanges and into private wallets, the overall selling pressure in the market could be diminishing. This shift in behavior could “indicate reduced selling pressure, potentially favoring a bull market if demand continues to grow,” the analyst noted.

The reduction in available Bitcoin on exchanges typically signals a move toward long-term holding, as investors transfer their assets to more secure, private wallets. Such trends can often lead to reduced selling pressure, potentially stabilizing or boosting Bitcoin’s price over the long term.

However, with ongoing liquidations and a cautious investment landscape, the cryptocurrency’s immediate path remains unclear.

In the coming weeks, market participants will closely watch economic indicators and Federal Reserve signals for any signs of a shift in monetary policy. These factors, coupled with Bitcoin’s dwindling exchange reserves, will likely shape the cryptocurrency’s direction as it continues to test the resilience of investors and traders alike.